Working Conditions

Mobility

Performers often travel abroad to seek new employment opportunities. Some may do so because they are hired to perform in international productions or with a touring company. Some may be drawn by a better offer of employment opportunities. However, employment and social security are fundamentally a national matter and performers are often subject to multiple regimes that may profoundly affect their eligibility to social security, pension, unemployment and other benefits in their home country.

FIA advocates for international OECD ( Home page – OECD ) standards to be amended and for artists to be treated like any other employed worker, taxed only in the country of residence when work abroad is limited in time, or self-employed persons, predominantly taxed in the country of residence. The Federation is also a member of On The Move (On the Move (on-the-move.org), a European network seeking to raise awareness about mobility issues affecting professional artists and advocating for measures to address these problems.

FIA enhances international cooperation and solidarity among its membership to extend the benefits of union agreements to performers working abroad and encourages partnerships with other industrial sectors to secure acceptable terms and conditions for performers employed there. The federation also campaigns for decent travelling conditions and compensation for all artists on tour.

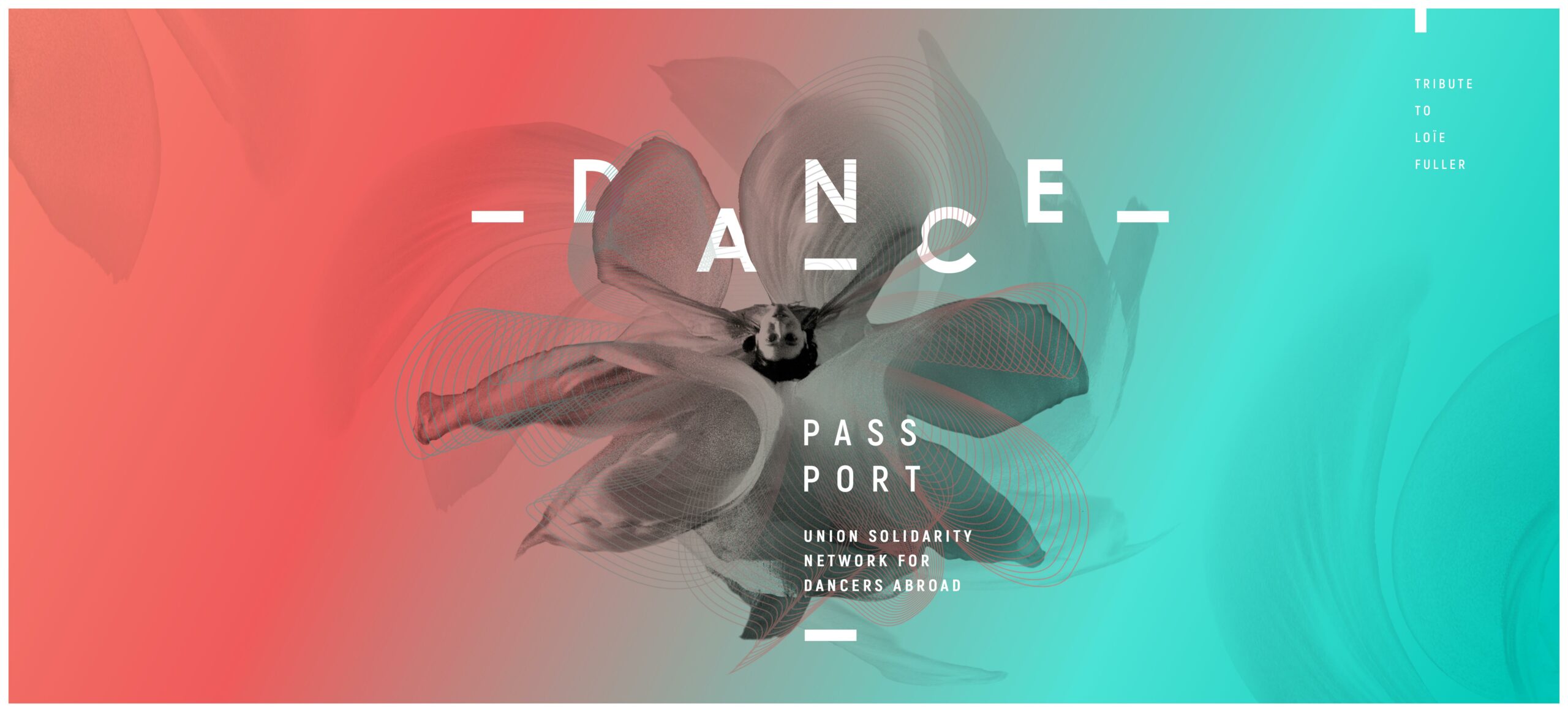

Dance Passport

The European Union Solidarity Network for Dancers Abroad has been relaunched and specific resources, articles and contacts are now accessible online on a dedicated website

...

Explore Other Working Conditions Topics

Health and Safety

The health and safety of performers is a key priority for FIA.

Labour Rights and Collective Bargaining

FIA strongly ...

EU Social Dialogue

FIA is part of the workers’ delegation in two European ...

Status of the Artist

What defines the status of artists is the consideration that society holds...